(Bloomberg) — The dollar weakened and US stock futures slipped as traders prepared for US jobs data that may determine the size of a Federal Reserve interest-rate cut this month.

Most Read from Bloomberg

Listen to the Bloomberg Daybreak Europe podcast on Apple, Spotify or anywhere you listen.

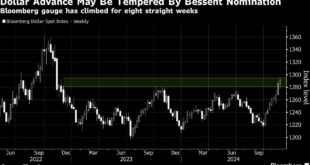

Bloomberg’s gauge of the greenback dropped for a third day amid speculation a worse-than-expected payrolls outcome may spur the Fed into making a 50 basis-point cut this month. Most Asian currencies strengthened, led by the yen and Philippine peso. Asian equities were mixed, while Hong Kong stock trading was shut due to a typhoon.

There’s limited event risk to be concerned about in Asia “so again the session will be defined by further pre-positioning ahead of US payrolls,” said Chris Weston, head of research at Pepperstone Group in Melbourne. “Traders will use the time in front of the screens to review, massage and manage positioning and exposures and the possible cross-market volatility that can kick up.”

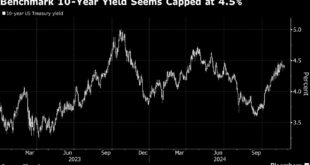

Treasury yields edged lower in Asia, adding further downward pressure on the greenback. The benchmark 10-year yield dropped one basis point to 3.71%. The so-called whisper number for payrolls among Bloomberg terminal users suggests an addition of just 155,000 workers for August, below the median economist estimate of 165,000.

Currency traders haven’t been this animated before a US jobs report in more than a year. Options used to gauge swings in the dollar versus its main trading partners hit the highest level since March 2023. So-called risk reversals, a barometer of market positioning, show bearish sentiment prevails for the US currency, and some traders are steering clear of short-term bets altogether, given the uncertainty.

Interest-rate swap contracts show a roughly 35% chance the Fed will cut by 50 basis points when it meets Sept. 17-18. Still, a quarter-point reduction is still favored by many traders and remains the more popular call among economists.

Currency strategists see a strong chance the yen will test its August high versus the dollar if the payrolls data boost bets for a 50-basis-point move.

The yen “is where the action will be” if there is any surprise in the figures, said Gareth Berry, a strategist at Macquarie Group Ltd. in Singapore The dollar will be “in deep trouble” versus Japan’s currency if the unemployment rate ticks up to 4.4%, he said.

Typhoon Impact

Hong Kong scrapped trading of its $4.9 trillion stock market on Friday as the city prolonged a storm warning due to Super Typhoon Yagi, which skirted the region overnight toward southern China.

Elsewhere in Asia, China may be facing new export controls on critical technologies by the Biden administration. Washington has cracked down on China’s ability to access cutting-edge technologies needed for artificial intelligence, over fears that advanced chips and components could lend Beijing a military edge.

Chinese brokerage stocks gained after two of the largest state-backed brokers said they are looking to combine. Analysts said the merger may encourage other firms to follow suit.

Fed Speakers

Traders are also awaiting comments from two Fed speakers later Friday. New York Fed President John Williams and Fed Governor Christopher Waller are scheduled to make comments following the payrolls numbers.

“The danger in really ‘bad news’ is that even if the Fed is prepared to react aggressively, it might be too late to stave off real economic weakness,” said Steve Sosnick at Interactive Brokers. “But there is a worry that if the news is ‘too good,’ the Fed might be reticent to cut rates as fast as the market has come to expect.”

Oil headed for its biggest weekly loss in almost a year on concerns about soft demand and ample supply, even as OPEC+ delayed a planned increase in output by two months. Gold was little changed as traders digested the latest US data readings. Iron ore remained on track for its worst week since March, with few signs of a recovery for China’s steel market.

Key events this week:

-

Eurozone GDP, Friday

-

US nonfarm payrolls, Friday

-

Fed’s John Williams speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.3% as of 6:41 a.m. London time

-

Japan’s Topix fell 1.3%

-

Australia’s S&P/ASX 200 rose 0.3%

-

The Shanghai Composite fell 0.4%

-

Euro Stoxx 50 futures fell 0.3%

-

Nasdaq 100 futures fell 0.6%

-

Australia’s S&P/ASX 200 rose 0.3%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.2%

-

The euro was little changed at $1.1115

-

The Japanese yen rose 0.7% to 142.48 per dollar

-

The offshore yuan rose 0.1% to 7.0814 per dollar

-

The Australian dollar fell 0.3% to $0.6720

-

The British pound was little changed at $1.3173

Cryptocurrencies

-

Bitcoin rose 0.6% to $56,392.19

-

Ether rose 0.5% to $2,380.16

Bonds

-

The yield on 10-year Treasuries declined two basis points to 3.71%

-

Japan’s 10-year yield declined 1.5 basis points to 0.855%

-

Australia’s 10-year yield declined three basis points to 3.89%

Commodities

-

West Texas Intermediate crude fell 0.1% to $69.06 a barrel

-

Spot gold rose 0.1% to $2,519.77 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Richard Henderson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link

meganwoolsey Home

meganwoolsey Home