Palantir (NYSE: PLTR) and UiPath (NYSE: PATH) represent two different ways to invest in the growing artificial intelligence (AI) market. Palantir mines data from disparate sources to help its government and commercial clients make data-driven decisions, and UiPath’s software robots help companies automate repetitive tasks.

Palantir went public via a direct listing in September 2020. Its stock started trading at $10, and it’s more than quadrupled to a record high of more than $43. It was also added to the S&P 500 this September. UiPath went public via a traditional IPO at $56 in April 2021, but it now trades at $13. Let’s see if Palantir will remain the better AI stock for the foreseeable future.

How Palantir proved the bears wrong

Palantir was founded more than two decades ago in response to the Sept. 11 attacks. It was partly funded by the CIA’s Q-Tel venture arm, and it was reportedly used to track down Osama bin Laden in 2011. Most U.S. government agencies now use Palantir’s Gotham platform to manage their data, and it says its ultimate goal is to become the “default operating system for data across the U.S. government.” It’s also been expanding its Foundry platform for large commercial customers.

Palantir initially claimed it could grow its revenue by at least 30% annually through 2025. Its revenue increased 47% in 2020 and 41% in 2021, but only grew 24% in 2022 and 17% in 2023. It blamed that slowdown on the uneven timing of its government contracts and tougher macro headwinds, which curbed Foundry’s commercial growth.

But as Palantir’s top-line growth cooled off, it reined in its spending and turned firmly profitable on a generally accepted accounting principles (GAAP) basis in 2023. Those stable profits set it up for its recent inclusion in the S&P 500.

Palantir expects its revenue to increase 23%-24% this year as it secures new government contracts for Gotham, expands Foundry’s higher-growth U.S. commercial business, and launches new generative AI tools for processing large amounts of data. Analysts expect its GAAP EPS to more than double for the full year.

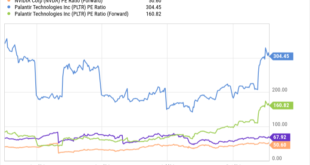

From 2023 to 2026, analysts expect its revenue and GAAP EPS to grow at a compound annual growth rate (CAGR) of 22% and 56%, respectively, as it scales up its business. Those growth rates are impressive, but a lot of that optimism is already baked into the stock at 184 times next year’s earnings and 29 times next year’s sales.

How UiPath proved the bulls wrong

UiPath gained a first-mover advantage in the robotic process automation (RPA) software market when it was founded nearly two decades ago. Its RPA tools can be plugged into an organization’s existing software to automate repetitive tasks like onboarding customers, entering data, processing invoices, and sending out mass emails. Its new AI services can also analyze the data that flows through those robots.

UiPath is now the world’s largest RPA software provider, and its revenue surged 81% in fiscal 2021 (which ended in January 2021) and 47% in fiscal 2022. Its revenue only rose 19% in fiscal 2023 as the macro and geopolitical headwinds drove many companies to rein in their software spending, but accelerated again with 24% growth in fiscal 2024.

For fiscal 2025, UiPath expects its revenue to only rise 9%. It mainly blamed that slowdown on the rough macro environment again, but it also coincided with the rapid adoption of newer generative AI tools that can automate many of the same repetitive tasks. The abrupt resignation of its CEO Rob Enslin this year raised even more red flags.

From fiscal 2024 to fiscal 2026, analysts expect UiPath’s revenue to grow at a CAGR of 11%. But they also expect the company to stay unprofitable on a GAAP basis — and it could struggle to narrow its losses as it tries to keep pace with newer generative AI tools. UiPath’s stock only trades at 4 times next year’s sales, but it could struggle to command a higher valuation unless it stays relevant in the rapidly shifting AI market.

The better buy: Palantir

I wouldn’t rush to buy either of these stocks right now. Palantir’s stock still looks a bit too pricey, and UiPath hasn’t presented any viable ways to reignite its growth engines yet. But if I had to choose one, I’d stick with Palantir because it’s larger, growing faster, is more profitable, has a wider moat, and has been added to the S&P 500 index.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Leo Sun has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies and UiPath. The Motley Fool has a disclosure policy.

Better Artificial Intelligence Stock: Palantir vs. UiPath was originally published by The Motley Fool

Source link

meganwoolsey Home

meganwoolsey Home