Tesla (TSLA) stock fell during morning trading on Friday, after its highly-anticipated robotaxi reveal failed to impress investors.

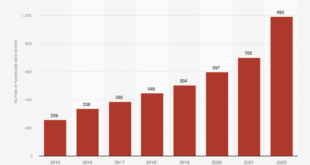

The electric vehicle maker’s shares were down around 7.5% on Friday morning after being down about 6% during pre-market trading. Its shares closed down almost 1% Thursday before the event.

Tesla chief executive Elon Musk unveiled the company’s Cybercab self-driving car prototype on Thursday night. The robotaxi is expected to be the EV maker’s first car that is capable of autonomous driving. While Tesla offers driving assistance software for self-driving, the vehicles still require a driver.

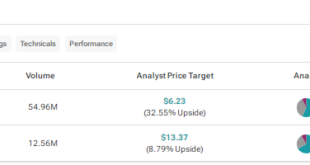

Tesla expects the Cybercab to eventually be available for sale to consumers at less than $30,000. The company has reportedly scrapped or delayed its plans for the Model 2, a planned $25,000 electric car, to focus on the robotaxi. Some analysts had expected Tesla to show off a preview of the Model 2 Thursday, although it received no mention from the company.

Musk on Thursday said the Cybercab will enter production “probably” in 2026 or “before 2027,” which isn’t likely to stir confidence in investors skeptical of the CEO’s often-delayed promises. A concept for a refreshed Roadster has been public since 2017 and production was expected to start in 2025, but the project’s status is unclear.

The company’s falling shares are likely due to uncertain timing, Gene Munster, managing partner at Deepwater Asset Management, said Friday in a post on X.

“Timing of Cybercab is still two plus years away, too far for the incremental investor to put much weight into the opportunity and the timing asks existing investors to continue the waiting game,’ Munster said, adding that the EV maker’s investors are waiting for other company results such as “improving margins, higher delivery growth rates and FSD [full self-driving].”

Musk’s failure to mention a “more affordable” model that he previously said could be available sometime late this year or mid-2025 is another reason for the stock slide, Munster said.

“The cheaper car is still in the works,” Munster said. “My guess is timing will be late 2025 for initial production. The reason why they held off was there is little reward for them to highlight a cheaper model given it risks buyers hitting the pause today on Model 3 and Y.”

— William Gavin contributed to this article.

meganwoolsey Home

meganwoolsey Home