Right now, Apple (NASDAQ: AAPL) is the world’s largest company by market cap. However, investors need to be aware of some problems under the hood.

Instead of Apple, I think there are much better buys right now, including Nvidia (NASDAQ: NVDA), Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), and Meta Platforms (NASDAQ: META). These three provide significant long-term upside that should allow them to outperform Apple.

What’s going on with Apple?

Apple reached the top of the rankings of the world’s largest companies with shockingly low revenue growth. Sales of iPhones haven’t increased meaningfully since the pandemic began, and investors put a lot of hope into the iPhone 16 being the generation that turns it around, mainly because of its Apple Intelligence integration. But the latest reports say that its sales are below expectations, which could spell disaster for the stock.

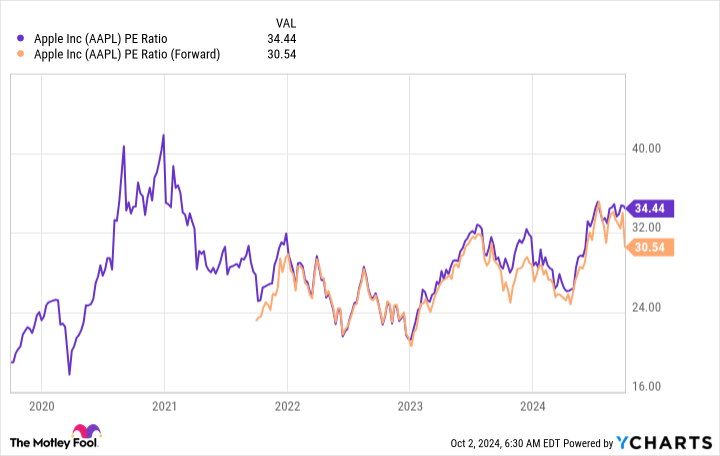

It trades at 34 times trailing earnings and 31 times forward earnings. That’s a premium investors would expect to pay for a company that’s growing rapidly.

In Apple’s latest quarter, however, sales only grew by 4.9% and earnings per share (EPS) by 10.2%. Those aren’t figures that support the stock’s lofty valuation.

The immediate future looks slightly better, but not enough to justify today’s price. In fiscal 2025, ending Sept. 30, 2025, Wall Street expects 8% higher revenue and 17% EPS growth. Compared to the following three options, Apple stock doesn’t look attractive.

These tech stocks look to outperform Apple over the next few years

Instead, I would urge you to consider Nvidia, Alphabet, and Meta Platforms (and many other companies as well).

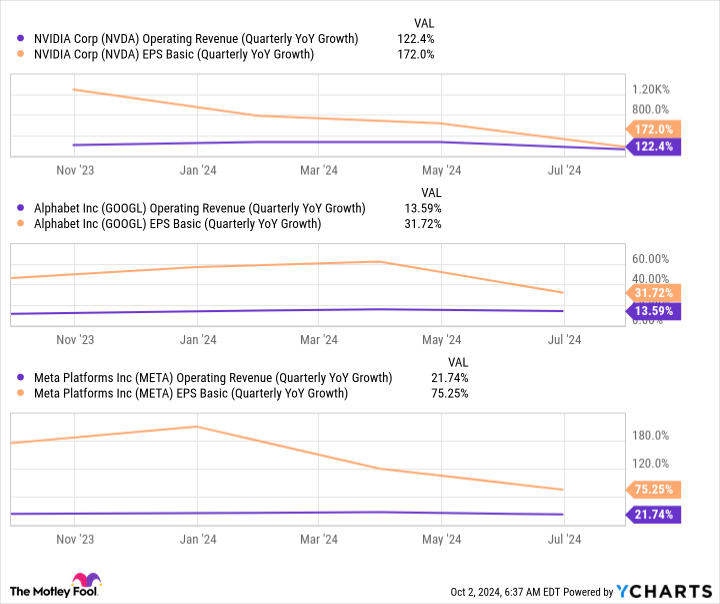

Let’s start with Nvidia. Its graphics processing units (GPUs) are powering artificial intelligence (AI), and demand doesn’t seem to be slowing down any time soon.

Alphabet is Google’s parent company, and its market dominance among search engines allowed it to capitalize on advertising in one of the most lucrative areas on the internet.

Meta Platforms is the parent of social media sites like Facebook and Instagram, and it also generates a lot of its money from ads on its platforms.

All three of these companies are far outperforming Apple in revenue and EPS growth.

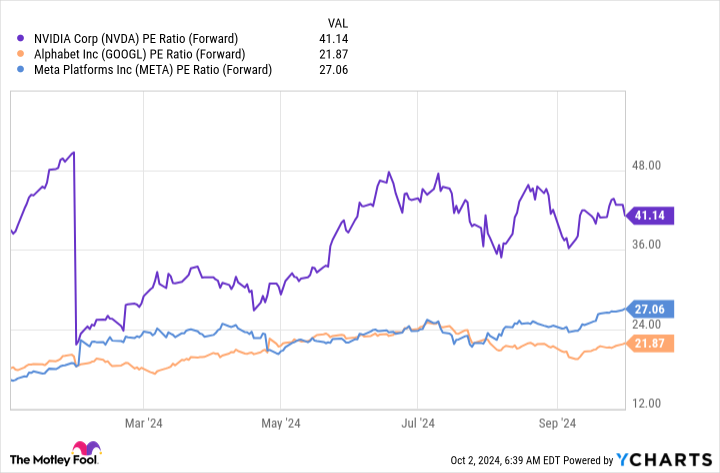

Despite doing substantially better than Apple, two of them don’t hold a premium in comparison to it, while Nvidia isn’t that much more expensive.

As an investor, I’m looking for companies with sustainable business models, faster growth, and lower stock valuations. Compared to Apple, both Meta and Alphabet achieve that, so buying those two instead makes a lot of sense.

Nvidia isn’t cheaper now, but its prospects are far more lucrative. While its days of increasing revenue at a triple-digit pace are over, if it keeps up its current rate, it will still post impressive growth.

In its 2025 second quarter (ending July 28), Nvidia grew revenue 15% sequentially, and its third-quarter projections indicate sales will rise another 8.3% over the previous period. Apple can’t muster this kind of increase year over year, yet Nvidia is doing it one quarter after another.

If the stock price doesn’t move, this will rapidly drive down Nvidia’s valuation. However, with AI being such a hot investment topic, the stock will continue to be strong and will likely maintain its premium over other tech stocks.

As a result, its stock performance will be closely tied to its revenue and EPS growth, which will easily allow it to outperform the iPhone maker.

Apple is a great company, but it isn’t the juggernaut it used to be. Investors should start looking for other investment opportunities.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 768% — a market-crushing outperformance compared to 167% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Apple made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of September 30, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Apple, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.

Should You Forget Apple and Buy These 3 Tech Stocks Instead? was originally published by The Motley Fool

Source link

meganwoolsey Home

meganwoolsey Home