-

Warren Buffett has sold 23% of his Bank of America stake for about $10 billion since mid-July.

-

Berkshire Hathaway’s American Express stake is now more valuable than its Bank of America bet.

-

Buffett cashed in about 56% of his massive Apple bet in the first half of this year.

Warren Buffett has followed up the surprise paring of his Apple stake by taking a knife to another of his largest holdings: Bank of America.

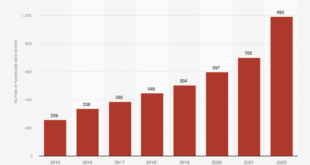

The famed investor’s Berkshire Hathaway sold about 239 million shares or around 23% of its stake in the banking giant between July 17 and October 2, Securities and Exchange Commission filings show.

Buffett, 94, offloaded the shares at prices ranging from about $39 to $44, generating roughly $10 billion in proceeds — and he may not be done selling.

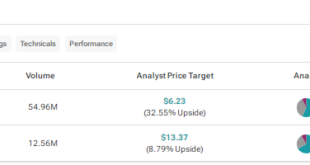

Berkshire has slashed its stake from 1.03 billion shares to 794 million shares, reducing its ownership from 13.2% to 10.2%. At Thursday’s close, its remaining shares were worth just over $31 billion.

If the conglomerate keeps selling and ceases to be a 10% shareholder, it will no longer have to update the market within two days of most transactions involving Bank of America stock.

The Wall Street titan was Berkshire’s second-largest holding after Apple at the end of June — the positions were worth about $41 billion and $84 billion each. Buffett’s piece of American Express, worth around $41 billion, is now more valuable than his Bank of America bet.

Buffett’s iconic stake in Coca-Cola, worth $28 billion, could soon be worth more, too, if the disposals continue or the stocks move the right way. Berkshire is set to reveal the contents of its portfolio as of the end of September in a mid-November filing.

No explanation yet

The “Oracle of Omaha” hasn’t publicly said why he’s dumping Bank of America, but there are a few plausible reasons. He might be taking profits after a good run: the stock has gained about 50% in the past year and touched its highest level in over two years on July 17, the day that Buffett began selling.

Buffett cited the prospect of higher capital-gains taxes as one reason for cashing out some of his Apple profits, and that could be true for Bank of America, too. Berkshire’s Apple position was worth around $174 billion at the end of 2023, but Buffett and his colleagues cut it by 56% in the first half.

Based on the cost bases of those positions, Berkshire has more than quintupled its money on Apple and tripled it on Bank of America, and it has now realized a sizable chunk of those paper gains.

Buffett might also be rebalancing Berkshire’s $300 billion stock portfolio in line with his smaller Apple bet. Or he might have soured on Bank of America’s outlook; he’s exited several of its peers including JPMorgan and Goldman Sachs in recent years.

There’s also a chance he’s gathering cash to make an elephant-sized acquisition. But Berkshire has plenty of dry powder for deals: it held a record $277 billion in liquid investments at the end of June, after dumping over $90 billion worth of stocks in the second quarter.

Bathtub billions

Buffett’s Bank of America bet dates back to 2011, when he had the idea to invest in the bank while taking a bath. He initially got tied up in the bank’s call center but eventually reached CEO Brian Moynihan.

The pair agreed Buffett would invest $5 billion in exchange for $5 billion of preferred stock paying a 6% annual dividend, plus warrants to buy 700 million common shares for a set price at any point over the next decade.

Buffett exercised the warrants in 2017, receiving over $20 billion worth of common stock at a cost of about $5 billion, which he covered by redeeming virtually all of his preferred shares.

True to his bargain-hunter reputation, Buffett topped up his Bank of America stake in 2020, when the pandemic-hit stock was trading around $25. He purchased about $2.1 billion worth over 12 consecutive trading days.

He looks to have made a killing on the investment, given he’s now sold nearly a quarter of it for around $40 a share. That’s close to 60% more than his purchase price in the summer of 2020, and more than five times the $7 or so he paid for the bulk of the position using warrants.

Read the original article on Business Insider

Source link

meganwoolsey Home

meganwoolsey Home