Nike (NKE) stock sank as much as 8% after hours Tuesday evening as the company reported fiscal first quarter revenue that missed estimates and withdrew its outlook for the year amid a CEO transition

The shoe giant reported first quarter earnings per share of $0.70, higher than Wall Street’s estimate of $0.52 and a 13% decline from the year earlier period. Meanwhile Nike’s revenue of $11.59 billion fell short of analyst estimates for $11.65 billion, and marked a 10% decline from the year earlier period.

Nike continued to sales slump in both its direct-to-consumer business and its wholesale division. Nike Direct revenues were $4.7 billion, a 13% decline from the same quarter a year ago. Meanwhile, Wholesale revenues were $6.4 billion, down 8% from the same period a year ago.

“A comeback at this scale takes time, and while there are some early wins, we have yet to turn the corner,” Nike CFO Matthew Friend said on the company’s earnings call Tuesday night.

Morningstar equity analyst David Swartz told Yahoo Finance that Nike’s report was “pretty much what people expected.”

“Nike has really been warning us since late last year, December of 2023, that the sportswear market was not very strong and that its innovation cycle was not looking particularly good for the beginning of the fiscal year 2025 either,” Swartz said. “Right now, Nike is in a situation where it doesn’t have a lot of new products coming out, and it is pulling back on some other products.”

The quarterly report is Nike’s first since the company announced a CEO change amid lackluster sales growth. Elliott Hill, a former Nike executive who retired in 2020, will replace John Donahoe as CEO on Oct. 14. The news initially sent Nike stock up as much as 10%.

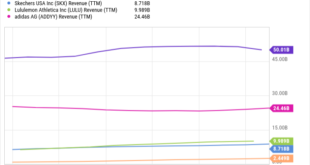

Nike stock has slumped this year, falling more than 25% prior to the CEO changeup announcement on Sept. 19 amid concerns over slowing sales growth and pressure from rising competitors in the space like On (ONON) and Deckers’ (DECK) Hoka brand.

“This industry in sportswear is much more competitive now than it was five years ago,” Swartz said. “Donahoe didn’t understand that until it was a little bit too late.”

Tuesday’s print marked the sixth straight quarter Nike has reported single-digit revenue growth, or worse. The company also announced on Tuesday that its upcoming investor day has been postponed with no future date announced.

In a note to clients on Monday morning, Jefferies analyst Randal Konik wrote he doesn’t expect Hill to have an impact on Nike’s performance until the fiscal year 2026. Therefore, Konik believes shares are in “no man’s land and likely remain range-bound for a number of quarters.”

Josh Schafer is a reporter for Yahoo Finance. Follow him on X @_joshschafer.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

meganwoolsey Home

meganwoolsey Home