It’s not hard to paint a rosy picture for hydrogen stocks like Plug Power (NASDAQ: PLUG). According to a recent report by global consultancy McKinsey & Co, “global clean hydrogen demand is projected to grow significantly by 2050, but infrastructure scale-up and technology advancements are needed to meet projected demand.” As a company that provides that infrastructure and technology, Plug Power is in the driver’s seat to meet this growth in demand that could be sustained for decades.

With a market cap of just $1.8 billion, there is certainly plenty of upside potential to Plug Power stock. Deloitte, another global consultancy, predicts that the global market for hydrogen could reach $1.4 trillion by 2050. But what about the next three years? The true growth potential of Plug Power stock might surprise you.

Hydrogen demand is still in its infancy

While wind and solar power get most of the attention, hydrogen power has a large opportunity to help the world transition away from fossil fuels. That’s because hydrogen fuel is particularly good at decarbonizing what economists call “hard to abate” sectors. Asphalt, cement, steel, shipping, aviation — these are just a few areas where replacing fossil fuels with renewable energy remains very difficult.

Hydrogen fuel is a viable substitute for two reasons. First, it has a much higher energy density than batteries. This makes it a suitable option for trucking and aviation, where hauling voluminous, heavy batteries isn’t practical. Additionally, sectors like steelmaking, cement production, and petrochemical require very high temperatures to operate, sometimes in excess of 1,000 degrees. Hydrogen can create this level of high heat, whereas electricity — whether produced by clean or dirty forms of energy — struggles.

If we want to decarbonize hard-to-abate sectors of the economy, hydrogen has a strong case. But demand is still very much in its infancy. There’s a reason why research from Deloitte and McKinsey & Co focuses on timelines all the way out to 2050 — it will take that much time for the hydrogen economy to take off.

Hydrogen fuel in general still isn’t cost-competitive with fossil fuels. And hydrogen can be produced with cleaner or dirtier methods, meaning that a transition to hydrogen fuel won’t necessary decarbonize the sector in question. Plus, hydrogen requires a lot of infrastructure — everything from production and transportation to distribution. It also needs a fleet of end users ready to accept it as a fuel source.

Hydrogen fuel has a lot of promise. But there are clear hurdles that make this a multi-decade story. Don’t expect this equation to change over the next three years.

Will Plug Power be able to ride the clean energy tidal wave?

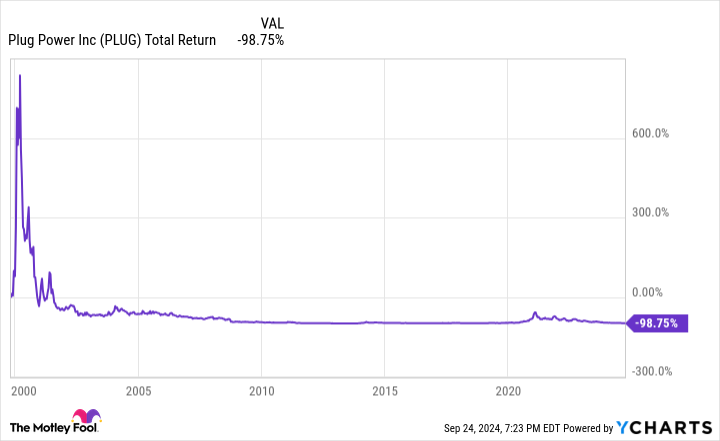

There’s no doubt that Plug Power has an early start. The company was started in 1997, and went public in 1999 at the height of the dot-com bubble. Suffice it to say, it’s been a long journey. Long-term investors haven’t been that satisfied. If you had invested in the company during its IPO, you’d have just 1.25% of your original capital left.

The issue facing Plug Power over the next few years is no different than the challenges that have plagued the company since its founding. Hydrogen power, for all its promise, is still ahead of its time, and an inflection point is nowhere close. Goldman Sachs estimates Plug Power’s equity duration — or the weighted average duration of its cash flows — to be roughly 26 years.

That’s a long time to be waiting. And during the interim, expect heavy dilution. Over the last few decades, Plug Power shares have struggled due to a lack of profitability, but also due to the massive share dilution necessary to keep the company afloat.

Over the next three years, there aren’t many major catalysts to look forward to. Raising capital will continue to be a challenge, and expect management to continue touting the potential of the hydrogen economy as a whole. But even if the hydrogen economy does unexpectedly take off, there’s no guarantee that Plug Power’s technology in particular will win.

Where will Plug Power be in three years? Likely in the same place it is today: Struggling for financing, hoping that a hydrogen inflection point arrives much sooner than expected.

Should you invest $1,000 in Plug Power right now?

Before you buy stock in Plug Power, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Plug Power wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Where Will Plug Power Be in 3 Years? was originally published by The Motley Fool

Source link

meganwoolsey Home

meganwoolsey Home