Initial reports that Apple‘s (NASDAQ: AAPL) latest batch of smartphones were witnessing weaker demand than last year’s models weighed on the stock recently. But it looks like those reports may not hold much water after all, as the company’s iPhone 16 lineup seems to be receiving a solid response from customers.

More importantly, a closer look at the potential sales prospects of the latest iPhone models indicates that Apple could witness a nice bump in sales going forward.

A big upgrade cycle could help Apple sell more iPhones

Counterpoint Research estimates that iPhone 16 models are witnessing robust demand in India, with sales reportedly jumping between 15% and 20% on the day the smartphones went on sale in that country. It is worth noting that Apple’s sales in India surged an impressive 35% in fiscal 2024 (which ended in March this year), and the strong start that the company’s latest devices are enjoying in that market suggests that the momentum is set to continue.

Meanwhile, T-Mobile CEO Mike Sievert also pointed out that the carrier is selling more iPhone 16 models this year as compared to last year. Though Sievert pointed out that the delayed rollout of Apple Intelligence could lead to a longer buying cycle, it is worth noting that the iPhone maker could eventually enjoy strong sales because of an aging installed base of iPhones.

Dan Ives of Wedbush Securities estimates that out of an installed base of 1.5 billion iPhones, 300 million have not been upgraded in four years. So, with generative artificial intelligence (AI) features set to make their way to the latest Apple iPhones, there is a good chance that a significant chunk of these older iPhones could be upgraded. Given that Apple sold just under 235 million iPhones last year, the stage seems set for a big jump in the company’s shipments going forward.

That’s why investors may want to buy shares of Apple, considering that the tech giant’s growth is set to improve thanks to the arrival of its AI-enabled smartphones. However, there is another stock that’s set to benefit big time from the iPhone 16’s potential success, and investors can buy that company at a cheaper valuation right now — Taiwan Semiconductor Manufacturing (NYSE: TSM).

A shot in the arm for TSMC thanks to the new iPhones

Taiwan Semiconductor Manufacturing, popularly known as TSMC, is the company that manufactures the processors that power Apple’s iPhones. The A18 and A18 Pro processors inside the iPhone 16 models are manufactured using TSMC’s 3-nanometer (nm) process node.

Apple claims that its iPhone Pro models can deliver 15% performance gains while consuming 20% less power than last year’s models. Meanwhile, the A18 chip found on the iPhone 16 and iPhone 16 Plus is reportedly 30% faster and consumes 35% less power than last year’s phones. The improved processing power and low consumption will play a key role in helping the new iPhones run the Apple Intelligence suite of AI features and help the company tap a fast-growing niche.

Apple reportedly began manufacturing its latest iPhones in June this year and ramped up their production subsequently before they hit the market this month. This is one of the reasons why TSMC has witnessed a significant bump in its revenue of late. The Taiwan-based foundry giant’s monthly revenue increased 33% year over year in June, followed by a 45% increase in July and a 33% increase in August.

Apple is TSMC’s largest customer and reportedly accounted for a fourth of the latter’s top line in 2023. So it is easy to see why TSMC’s revenue has been growing at impressive levels of late. Of course, Nvidia is another key TSMC customer, as the semiconductor giant has been tapping the latter’s foundries to manufacture its AI chips. However, Nvidia reportedly accounted for 11% of TSMC’s revenue last year, which means that Apple moves the needle in a more significant way for the foundry giant.

Ives expects the production of iPhone 16 models to hit 90 million units in 2024, up by 8 million to 10 million units from last year’s models. This estimated increase in production by Apple seems to be contributing to TSMC’s impressive growth in recent months. More importantly, we saw earlier that there is a huge installed base of users that could move to Apple’s AI-enabled iPhones in the future. As a result, TSMC’s largest customer could continue to play a central role in driving its growth.

Even better, reports suggest that Apple may have already purchased all of TSMC’s manufacturing capacity of 2-nm chips for its 2025 iPhone lineup. It is worth noting that Apple has done a similar thing in the past when it purchased all of TSMC’s 3nm manufacturing capacity for a year in 2023 so that it can make enough iPhones.

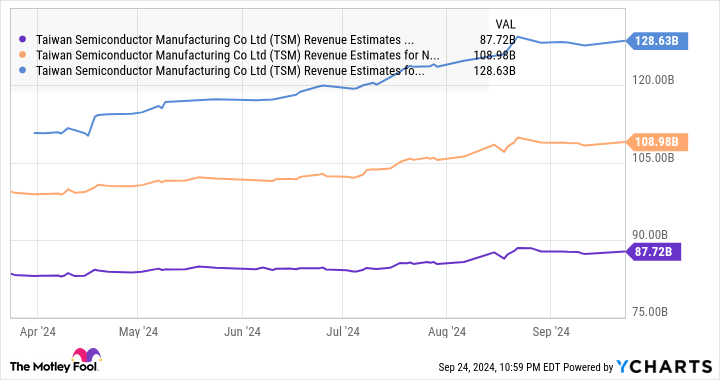

In all, TSMC’s growth prospects in the AI chip market thanks to customers such as Nvidia, along with its tight relationship with Apple, are the reasons why there has been a significant increase in the company’s revenue estimates for the next three years.

What’s more, TSMC is trading at 31 times trailing earnings and 21 times forward earnings right now. It is cheaper than Apple, which is trading at 34 times trailing earnings and 30 times forward earnings. So, TSMC stock gives investors a cheaper and more diversified way to capitalize on the potential growth in iPhone sales, as well as the secular growth of the AI chip market.

This is why investors should consider buying this semiconductor stock right now before it could fly higher following the 75% gains it has already clocked in 2024.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends T-Mobile US. The Motley Fool has a disclosure policy.

Prediction: Apple’s iPhone 16 Could Become a Runaway Hit, and Here Is 1 Stock to Buy Hand Over Fist Before That Happens was originally published by The Motley Fool

Source link

meganwoolsey Home

meganwoolsey Home