(Bloomberg) — Bitcoin retreated ahead of a widely expected interest-rate reduction by the Federal Reserve, a looming policy change due later this week that has global markets on edge.

Most Read from Bloomberg

The largest digital asset slid as much as 2.8% on Monday before paring some of the wobble to trade at $58,633 as of 7:03 a.m. in London. Tokens including second-ranked Ether and meme-crowd favorite Dogecoin also nursed losses.

The first US rate cut in more than four years heralds looser financial conditions, typically a positive backdrop for riskier assets such as cryptocurrencies. But investors are uncertain about the magnitude of the move anticipated for Wednesday, as well as how markets will react to updated projections from Fed officials — the so-called dot plot — and Chair Jerome Powell’s briefing.

“The cut is less important than the signaling during the press conference and the release of the updated dot plot,” said Sean McNulty, director of trading at liquidity provider Arbelos Markets. “If the guidance and press conference is significantly dovish, we’d expect Bitcoin to outperform to the topside.”

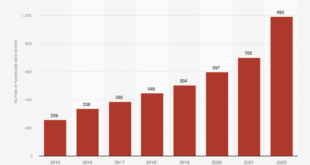

The latest drop in Bitcoin follows a 10% jump in the seven days through Sunday, the biggest weekly rally since July — that push higher potentially reflected reviving bets on a 50 basis points Fed rate cut. Officials are forecast to lower borrowing costs by at least 25 basis points at the upcoming policy meeting.

In the Bitcoin options market, traders are “pricing a significantly larger event weight than we have seen in recent times” for the Fed meeting, said Caroline Mauron, co-founder of Orbit Markets, a provider of liquidity for trading in digital-asset derivatives.

The monetary policy outlook has become arguably the dominant short-term driver of the cryptocurrency, overshadowing — at least for now — the twists and turns around the US presidential contest.

In the latest election drama, former President Donald Trump was unharmed following another apparent assassination attempt. The Republican nominee’s Secret Service detail opened fire at a man who was wielding an assault rifle at his West Palm Beach, Florida, golf course on Sunday.

Trump has embraced the digital-asset industry in search of donations and votes in a tight contest with Democratic rival Vice President Kamala Harris. His defiant response to an assassination attempt in July spurred a surge in Bitcoin at the time, on speculation that his chances of winning reelection had improved.

Bitcoin reached a record of $73,798 in March, boosted by demand for dedicated US exchange-traded funds. Inflows into the products have since moderated.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link

meganwoolsey Home

meganwoolsey Home