(Bloomberg) — Asian stocks are set for a cautious open Monday after a slew of worse than expected Chinese economic activity data landed over the weekend.

Most Read from Bloomberg

Futures point to a decline in Hong Kong shares, and a small gain for Australia’s benchmark. US equity futures were steady in early trading after the S&P 500 rose 0.5% on Friday. Moves in Asian markets may be exacerbated by thin trading with Japan and mainland China closed for a holiday.

Chinese factory output, consumption and investment all slowed more than forecast for August, while the jobless rate unexpectedly hit a six-month high. Home prices declined from the previous month, adding to a string of poor data that is deepening pessimism among traders wondering if authorities will initiate forceful stimulus to buttress the economy.

China’s central bank signaled late Friday it would step up its fight against deflation and prepare more policies to revive the economy, after credit data showed private confidence remained weak.

Sentiment will be hit in Asia on Monday as “the falls in housing prices are accelerating, with very little evidence of support coming from the measures that policymakers have rolled out,” said Tony Sycamore, an analyst at IG in Sydney. “The continued deleveraging in the property sector spells trouble for the rest of the Chinese economy” into the year-end.

The dollar was steady after what the Federal Bureau of Investigation called an apparent assassination attempt against former President Donald Trump. US Treasuries won’t trade in Asian hours due to the holiday in Japan.

Monday’s cautious open comes ahead of a swath of data and central bank decisions that will likely set up the direction of markets for the rest of the year and into early 2025. A Eurozone inflation reading is due as officials debate the pace of policy easing, followed by an expected rate cut by the Federal Reserve and policy decisions from Bank of England and Bank of Japan.

Treasury yields fell a second straight week with two-year notes closing at a two-year low on Friday as bets were revived on a 50 basis point rate cut by the Fed, with about 110 basis points of rate cuts priced by year-end, according to data compiled by Bloomberg. The S&P 500 jumped 4%, the best week of the year, with economically sensitive shares outperforming tech megacaps as traders rotated into companies that would benefit most from Fed policy easing.

“It is a big week ahead” and clearly the 25 or 50 basis point riddle needs to be solved, said Martin Whetton, head of financial markets strategy at Westpac Banking Corp. in Sydney. “At the very least a dovish cut should be expected given the run of data and the starting point for policy, and this should justify market forward pricing.”

With most major markets closed in Asia on Monday, traders will likely be cautious ahead of regional trade data and Bank Indonesia’s policy decision that comes just hours before the Fed. Global funds have been snapping up Southeast Asian assets as the prospect of interest-rate cuts and attractive valuations holds out the promise of supersized returns.

Should the Fed’s rate cut be non-recessionary driven, and growth outside the US trudges along, “then it is more likely the US dollar can remain back footed while other currencies sensitive to growth and rates outperform, such as the Korean won, Malaysian ringgit and Thai baht,” said Christopher Wong, a currency strategist at Oversea-Chinese Banking Corp. in Singapore.

Key events this week:

-

ECB speakers including Vice President Luis de Guindos and chief economist Philip Lane, Monday

-

US empire manufacturing, Monday

-

Singapore trade, Tuesday

-

Federal Reserve begins two-day meeting, Tuesday

-

US business inventories, industrial production, retail sales, Tuesday

-

Canada CPI, Tuesday

-

Indonesia rate decision, Wednesday

-

South Africa retail sales, CPI, Wednesday

-

UK CPI, Wednesday

-

Eurozone CPI, Wednesday

-

US rate decision, Wednesday

-

Brazil rate decision, Wednesday

-

Australia unemployment, Thursday

-

New Zealand GDP, Thursday

-

Taiwan rate decision, Thursday

-

Norway rate decision, Thursday

-

UK rate decision, Thursday

-

South Africa rate decision, Thursday

-

China loan prime rates, Friday

-

Japan CPI, interest rate decision, Friday

-

ECB President Christine Lagarde speaks, Friday

-

Bank of Canada Governor Tiff Macklem speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 8:25 a.m. Tokyo time

-

Hang Seng futures fell 0.2%

-

S&P/ASX 200 futures rose 0.2%

Currencies

-

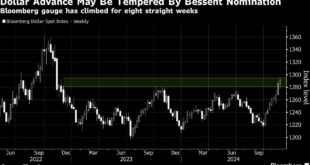

The Bloomberg Dollar Spot Index was little changed

-

The euro rose 0.1% to $1.1087

-

The Japanese yen was little changed at 140.84 per dollar

-

The offshore yuan was little changed at 7.0984 per dollar

-

The Australian dollar was little changed at $0.6709

Cryptocurrencies

-

Bitcoin fell 1.2% to $59,106.67

-

Ether fell 1.6% to $2,326

Bonds

Commodities

-

West Texas Intermediate crude rose 0.4% to $68.94 a barrel

-

Spot gold rose 0.1% to $2,580.22 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link

meganwoolsey Home

meganwoolsey Home