High-yield dividend stocks offer two key benefits. They provide regular cash flow through dividend payments and, when dividends are consistently reinvested, have often outperformed the S&P 500 over extended periods.

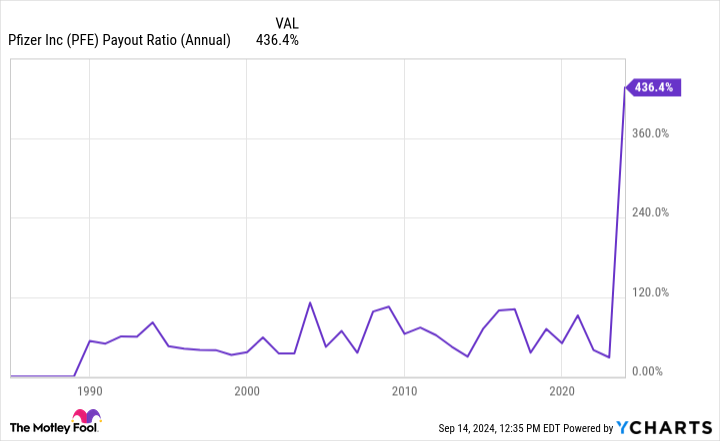

High yields, however, warrant scrutiny. They often result from falling share prices or overly generous payout policies. The payout ratio, which measures the proportion of earnings distributed as dividends, is a critical metric. Ratios exceeding 75% can signal unsustainability, potentially leading to dividend cuts and subsequent stock price declines.

Pharmaceutical giant Pfizer (NYSE: PFE) stands out in this context. The company currently offers a mouthwatering 5.7% dividend yield — the highest among major drug manufacturers and one of the highest in the entire healthcare sector. However, Pfizer’s payout ratio of 436% raises significant concerns about sustainability.

Is Pfizer’s high dividend worth the risk? Let’s dig deeper to find out.

A pharmaceutical powerhouse facing challenges

Pfizer is a global pharmaceutical giant with an impressive portfolio of over 350 marketed medicines, 113 experimental candidates in clinical trials, and a presence in more than 200 countries. Despite this commanding position, the company’s stock has recently stumbled, plummeting 52% from its three-year high.

This significant decline primarily stems from the sales slump of Pfizer’s once-booming COVID-19 franchise. However, amid this key challenge, Pfizer’s current valuation may present an intriguing opportunity for both bargain hunters and yield-seeking investors.

Delving into the specifics, Pfizer’s shares now trade at a mere 9.6 times 2026 projected earnings, a notable discount in the typically premium-laden pharmaceutical sector. This attractive valuation, combined with the stock’s high dividend yield and Pfizer’s entrenched market position, creates a compelling value proposition for investors with a long-term horizon.

Dividend sustainability concerns

Pfizer’s 5.7% dividend yield, while attractive, raises significant sustainability concerns. The company’s payout ratio has skyrocketed to 436%, far exceeding the 75% threshold that typically signals potential dividend instability. This ratio is not only alarmingly high in absolute terms but also stands out as the highest among Pfizer’s big pharma and blue chip biotech peers.

Context is crucial, however. The pharmaceutical industry often experiences periods of elevated payout ratios due to its capital-intensive nature and the finite patent protection for branded medications. These factors can lead to temporary spikes in this metric. Indeed, the average payout ratio among Pfizer’s peer group is 141% — already quite high but still dwarfed by Pfizer’s 436%.

Wall Street’s reaction to these figures has been decidedly bearish. Pfizer’s shares have declined by 14% over the prior 12 months, reflecting investor skepticism about its ability to maintain its current dividend levels. This negative sentiment persists despite Pfizer’s strong commercial performance in the first half of the year, including several successful new drug launches.

Management’s stance and prospects

During Pfizer’s 2024 second-quarter conference call, management reaffirmed its commitment to maintaining and growing the dividend as a top priority. This stance is supported by the company’s 15-year streak of consecutive dividend increases and no reductions since the $68 billion Wyeth acquisition in 2009.

To bolster this commitment, Pfizer has implemented a cost-saving plan targeting $4 billion in net savings by year-end. This initiative aims to improve free cash flows and support short-term dividend sustainability.

Looking ahead, Pfizer’s pipeline includes several potential blockbuster cancer drugs, notably vepdegestrant for breast cancer and sigvotatug vedotin for lung cancer. If successful in clinical trials, these high-value medications could generate over $1 billion in annual sales.

Successful launches of these drugs could significantly boost Pfizer’s top-line growth and earnings power in the latter half of the decade. This improved financial performance could help bring the company’s payout ratio closer to its historical average of around 50%.

The verdict: A calculated risk worth considering

While nothing is guaranteed in investing, the market’s pessimistic outlook on Pfizer’s near-term prospects may be overdone. Management’s steadfast commitment to dividend growth, cost-cutting measures, and a promising drug pipeline suggest the potential for a turnaround.

Pfizer’s shares also currently trade at a steep discount relative to many of its big pharma peers, potentially providing a margin of safety for investors buying at current levels. While the elevated payout ratio is a concern, the company’s strong market position, diverse product portfolio, and proven innovation engine offer some reassurance that this situation will ultimately prove temporary.

Given these factors, Pfizer screens as an intriguing option for investors seeking high-yield opportunities. However, as with all high-yield stocks, monitoring the company’s financial health and dividend coverage will remain crucial.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

George Budwell has positions in Pfizer. The Motley Fool has positions in and recommends Pfizer. The Motley Fool has a disclosure policy.

Is Pfizer’s 5.7% Dividend Yield Worth the Risk? was originally published by The Motley Fool

Source link

meganwoolsey Home

meganwoolsey Home