Polygon, Algorand, Ripple and Solana may not be well known like their behemoth big brothers bitcoin and Ethereum.

That obscurity may not last long once the crypto-friendly Trump administration is up and running next year.

Experts predict a wave of applications for smaller digital currencies, as well as more crypto options ETFs, crypto index funds and others that trade in multiple currencies when the administration takes over in January. Ahead of the new administration, issuers recently applied to create ETFs that offer exposure to lesser-known currencies like HBAR/Hedera, Ripple and Solana.

The path to more crypto ETFs is already being cleared, with hedge fund manager Scott Bessent, who has declared “crypto is about freedom,” being nominated to run the U.S. Treasury Dept. SEC Chair Gary Gensler, who had repeatedly warned of digital currencies being susceptible to fraud and was widely seen as an impediment to more crypto ETFs being approved, may be replaced by blockchain lawyer Teresa Goody Guillen.

“We can expect a significant number of filings for additional ETFs in the crypto space” under a Trump administration, said Ric Edelman, founder of the Digital Asset Council of Financial Professionals and a member of the etf.com advisory board. “We’re at the very beginning.”

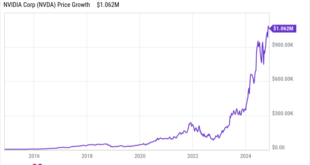

The incoming administration’s apparent goals of reshaping the industry come barely a year after the January launch of the first ETFs that trade in spot cryptocurrencies, which arrived after more than a decade of haggling between the SEC and hopeful issuers. They have been among the most successful launches in industry history, with assets surpassing $100 billion last week.

Edelman said he expects actively managed crypto ETFs to arrive as a more receptive administration takes the reins. He also expects crytpo index ETFs and funds that package more than one currency into a fund. First, he said, rules need to be sorted out that establish which digital currencies are securities under the SEC’s jurisdiction.

“You’ll have an explosion of crypto offerings the same way you have in the stock and bond market,” he said, adding that “Gensler wasn’t being cautious, he was being obstinate.”

The new administration and Gensler’s departure may mark a “new era” for crypto, said Tom Kiddle, co-founder of Palisade, a digital asset custodian backed by Ripple.

“It’s an opportunity to put the U.S. on a better path, one where innovation and regulation can coexist,” Kiddle wrote in an email.

Source link

meganwoolsey Home

meganwoolsey Home