Stock splits don’t change the value of a company, but they do often indicate that management expects the business will continue to perform well. And that solid operational performance can lead to wealth-building gains for shareholders.

If you have $1,000 or more to invest that you don’t need for everyday living expenses or to pay down debt, you have come to the right place. Read on to learn about two high-quality businesses that have recently split their stock. Both are set to deliver handsome rewards to their investors.

Stock-split stock to buy No. 1: Walmart

Inflation might be moderating, but the sharp rise in the price of food, shelter, and other essentials in recent years has many people searching for discounts wherever they can. In an increasingly high-cost world, Walmart (NYSE: WMT), with its prices, has become an oasis for these bargain-hunting consumers.

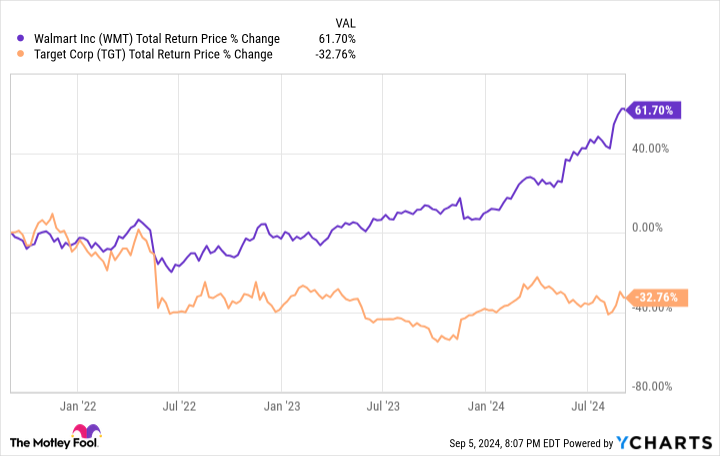

A vast selection of low-cost groceries and other household necessities is enabling Walmart’s stores to generate strong sales even as shoppers pull back on nonessentials. This is one reason it has outperformed Target and other competitors that rely more on discretionary sales.

The retailer’s online sales are also growing briskly. Booming demand for curbside pickup and delivery services fueled a 21% surge in Walmart’s e-commerce revenue in its most recent quarter.

An expanding army of third-party merchants further lifted sales on the company’s online marketplaces. These sellers are also driving the expansion of Walmart’s lucrative advertising business, which saw sales rise by 26%.

Better still, its investments in automation and artificial intelligence (AI) are boosting profits. The company’s operating income climbed by more than 8% to $8 billion on a 5% increase in revenue to $169 billion.

Walmart, in turn, chose to reward its shareholders with a 3-for-1 stock split in February. With its value-focused strategy clearly resonating with consumers, investors can expect the retail leader to continue to deliver strong returns.

Stock-split stock to buy No. 2: Nvidia

While Walmart is saving people money, Nvidia (NASDAQ: NVDA) is helping its customers create game-changing innovations. The semiconductor leader’s chip designs lie at the heart of the AI revolution.

Cloud computing giants like Microsoft and Alphabet are ramping up their spending on AI infrastructure. Nvidia’s chips are the best on the market, so it’s a huge beneficiary of this powerful trend. The chipmaker’s revenue leaped by 122% year over year to $30 billion in its most recent quarter. Net profits rose by an even more impressive 168% to $16.6 billion.

Yet the party is just getting started. Nvidia CEO Jensen Huang estimates that $1 trillion worth of data center equipment will need to be upgraded to new accelerated computing infrastructure to meet the torrid demand for AI. As the leading provider of AI chip designs, his company stands to profit from this massive spending more than any other company.

With its business firing on all cylinders, Nvidia dazzled investors with a 10-for-1 stock split in June. Wall Street analysts see plenty of upside remaining. For one, Rosenblatt Securities analyst Hans Mosesmann believes the stock is headed to $200 per share, fueled by strong sales of its forthcoming Blackwell chips. That would represent gains of more than 85% for investors who buy shares today.

Moreover, if you invest in Nvidia’s stock now, you’ll likely be buying alongside its management. The board of directors boosted its share repurchase program by $50 billion on Aug. 26.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Joe Tenebruso has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Microsoft, Nvidia, Target, and Walmart. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The Best Stock-Split Stocks to Invest $1,000 in Right Now was originally published by The Motley Fool

Source link

meganwoolsey Home

meganwoolsey Home