Coca-Cola’s (KO) third quarter turned out better than expected as consumers continue to be picky with their dollars.

On Wednesday morning, the soda giant posted revenue of $11.9 billion, beating expectations of $11.61 billion, though down from $12 billion in the year-ago period. Adjusted earnings came in at $0.77 a share, above estimates for $0.74.

“There’s part of the world, where consumers continue to be fairly resilient,” CFO John Murphy told Yahoo Finance over the phone, calling Coca-Cola “a beneficiary” in developed markets.

“On the positive side, we’ve seen spending pulling up, we have seen some of the drivers of that going forward sentiment, employment interest rates… moving in a better direction,” Murphy said, “On the flip side, there’s a lot of variables out there that are still uncertain, but at the root of it all, [consumers] continue to spend.”

For the full year, the company expects organic revenue growth of 10%, as higher prices have helped counter factors like ongoing pressure from cautious consumers, less favorable commodity costs, and more challenging trends in international markets.

J.P. Morgan analyst Andrea Teixeira said there was a “high bar into earnings,” in a note to clients, “While the headline was stronger and the guidance raise… most of the positive surprise came from better than expected price mix, while volumes were softer.”

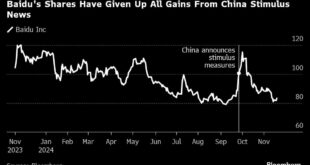

In North America, unit volume was flat, while global unit volume declined 1%, led by a slowdown in China, Mexico, and Turkey. Chinese consumers have been under pressure since COVID, but Coke is looking for potential bright spots next year as the government releases more economic stimulus, Murphy said.

Coca-Cola shares slipped 2% in premarket trading after the report’s release.

Rival PepsiCo (PEP) revised its 2024 sales outlook earlier in October after its North America and international sales lagged Wall Street’s expectations in the third quarter.

In a phone interview with Yahoo Finance, Pepsico CEO Ramon Laguarta said consumers are “very challenged” and that they are making a “lot of trade-offs” when it comes to food. Those trade-offs are weighing on the snacks business most acutely, per Laguarta.

Prior to the results, Teixeira wrote that consumers, especially in the US, are “more choiceful with less money in pocket”. That has forced Coca-Cola to raise prices to keep up growth.

“Coca-Cola is deploying its revenue growth management capabilities to offer price points both for single-serve in convenience & gas channel as well as multi-serve in larger stores,” Teixeira wrote. She pointed to the example of a single-serve 20 oz. can costing $2.25 to $2.69, compared to $1.99 previously.

meganwoolsey Home

meganwoolsey Home