One by one, they pull up at the St Regis Hotel in Riyadh.

Jannik Sinner, Carlos Alcaraz, Rafael Nadal, Daniil Medvedev and Holger Rune have arrived — only Novak Djokovic is yet to join the biggest stars in men’s tennis in accepting flowers, taking tea and talking with Turki Alalshikh, chairman of Saudi Arabia’s General Entertainment Authority (GEA).

They are the show and they are here in the Saudi capital for another. One of the richest exhibitions in tennis history, a $15million (£11.9m) bonanza the kingdom has called the ‘Six Kings Slam‘. The winner will take home $6m. Just being there earns over $1m.

Two weeks later, the WTA Tour will arrive for its season-ending finals, another $15million payday for the top eight women’s singles players of the year and the best women’s doubles teams. The ATP Next Gen Finals, an event featuring the top eight men in the rankings aged under 21, will come to Jeddah, Saudi Arabia’s second biggest city and commercial center, in December.

For the rest of the season, this Gulf nation will assume the role of the heart of the tennis universe, as unlikely as that might seem for a country where people barely play the sport and important tournaments have never taken place. After years of pushing, everything looks ready for Saudi Arabia’s billion-dollar move to become a major force in tennis to take off — with one major hitch.

After months of back-and-forth negotiations and due diligence between the kingdom and the entities that control tennis, the proposal for a major, mixed, 1000-level tournament (one rung below the four Grand Slams) to be held in Saudi Arabia in January or February is still at least three seasons away, a loose gesture at seismic change only slightly more fleshed out than it was a year ago when it set the sport aflame.

GO DEEPER

Saudi Arabia’s new $1billion proposal and the battle to control tennis

The biggest asset of Saudi Arabia’s three-headed push into tennis remains just an idea, with uncertainty on both sides over the tournament’s size, timing and financing. There remains no guarantee it will come to fruition. There has been no decision on who will participate or how much it will all cost, according to people briefed on the discussions who remain anonymous because they are not authorized to speak publicly about them.

The proposal has become such a question mark that it barely figured in meetings between the ATP and WTA Tours and the four tennis associations that control the Grand Slams at this year’s U.S. Open. Months of discussions between Saudi sports leaders and ATP executives — closely watched by WTA leaders — have failed to bring an agreement on even the most basic tenets of a tennis tournament:

- When should such an event take place?

- Will it be for just the top 56 men, or will it be a larger draw?

- Will it be a mixed event, as the Saudis would prefer, bringing the tournament on par with other 1000-level tournaments, such as Indian Wells, Madrid and Rome — some of the most prestigious of their kind?

Mounting complaints from players about the length and logistics of the sport’s current schedule have further complicated the discussions. Tour officials know this is not the moment to announce a new mandatory tournament, especially one that could shorten an off-season that most agree is already too brief.

Moreover, the answers to the questions above will significantly affect how much money the event might produce, and how much Saudi Arabia’s Public Investment Fund (PIF) wants to invest in the venture through its sports unit, SURJ Sports Investment. The grand promises of 12 months ago have contracted.

The PIF has partnered with the ATP and WTA Tours on large sponsorship deals. (PIF / Getty Images)

“It wasn’t at the forefront of the discussions because it doesn’t make sense,” said one of the people involved in the Grand Slam meetings at the U.S. Open. “We’re making the assumption that this is nothing to worry about.”

With their coup de grace still up in the air, the Saudis have opted for a more considered approach, people familiar with their plans say — an approach that lends this next month or two of tennis an air of provisionality. Saudi officials are resistant to talking about any grand plans they might have for tennis because they don’t know where those plans might go.

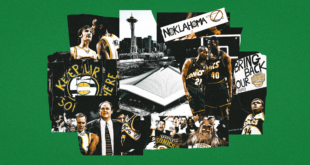

They will test the waters with their biggest and most expensive exhibition — the Six Kings Slam offers one of the biggest monetary prizes in tennis history.

Then the women will arrive for their tour finals, allowing the country to gauge interest and help determine how hard the kingdom should push to invest in tennis during the next decade. The Saudi contract with the WTA runs through 2026, allowing all parties to feel out each other’s strengths and weaknesses.

How many people will attend? Will the infrastructure hold? Will the media impressions roll in? The plan is to see how these events unfold, before pressing ahead with commitments for new ones.

That stance is starkly different from the Saudis’ actions this year. In rapid succession, the nation’s various sports and entertainment units announced new initiatives that made it one of the largest investors in tennis.

Three separate entities have pursued tennis investments without much coordination, though outsiders often lump them together.

In rapid succession during the past year, the GEA unveiled this Six Kings Slam, and the PIF announced major new sponsorship deals with the men’s and women’s tours, which included naming rights to the official rankings. The Ministry of Sport of Saudi Arabia, the Saudi Tennis Federation (STF) and the WTA Tour then announced a three-year deal to host the tour finals. Nadal was announced as an STF ambassador, helping promote tennis in the country and add legitimacy to its tennis interests in the eyes of the rest of the world.

Representatives of the PIF held talks with executives of Sinclair Broadcast, which owns the Tennis Channel, about acquiring a major stake in the network. According to people involved with those talks, who spoke anonymously to protect relationships, negotiations broke down when Sinclair raised the asking price from $750million to more than $1billion.

These moves raised Saudi Arabia’s tennis profile, but its potential new tournament at the start of the season was seen as the most important of its tennis investments — and its most divisive. It bid for that event through PIF and SURJ, but the financial ramifications almost paled compared to the existential angst coursing through tennis at the news of the kingdom’s pursuit of the tournament. It would cement Saudi Arabia’s place at the center of the sport, bringing with it an extensively criticized human rights record.

Upon the spring announcement of the country’s deal to host the WTA Finals, Human Rights Watch said, “Torture and imprisonment of peaceful critics of the government continues. Courts impose decades-long imprisonment on Saudi women for tweets.”

Former players, including Chris Evert and Martina Navratilova, publicly criticized “partnering a country with a history of repressive laws against women, that criminalizes homosexuality and free speech, and that in 2018 murdered Jamal Khashoggi, a dissident journalist who had travelled to the Saudi consulate in Istanbul, Turkey, to get documents he needed for a marriage license,” as The Athletic wrote in April.

When Saudia Arabia’s pursuit of tennis first came to light, at Wimbledon last year, it prompted the Grand Slams to pursue a counter-offensive that amounted to an attempted takeover of the sport.

Saudi Arabia’s moves into tennis have roiled the organisations behind the Grand Slam tournaments. (Henry Nicholls / AFP via Getty Images)

Tennis Australia had the most to lose. Any tournament in the early part of the year would significantly impact tuneup events in Australia and New Zealand before the Australian Open.

Led by Tennis Australia, the Grand Slams banded together to propose a new format for the entire season, with roughly 14 tournaments included in a so-called ‘premium tour’ for roughly the world’s top 100 players.

The move was an attempt to cleave the biggest non-Grand Slam tournaments from the men’s and women’s tours. The Grand Slams’ organisers also aimed their efforts at players, who have long complained about their arduous schedule’s duration.

In response, the ATP and the WTA pushed ahead with their lucrative sponsorships with Saudi Arabia. Those deals produced hundreds of millions of dollars in much-needed revenue for the tours, some of which will filter down to the players as prize money and bonus payments. Then, at this year’s Indian Wells, the Grand Slams moved to present their plan to the power brokers of tennis, but could not deliver something fully fleshed out. That idea too stalled, smothered by the inertia and fragmentation at the heart of tennis’ corridors of power.

GO DEEPER

Inside tennis’ corridors of power: A fractured hall of mirrors where nothing is as it seems

Since then, top players have been airing their complaints about the schedule again, especially the tours’ decision to extend the length of several of the mandatory Masters 1000 tournaments from seven to 12 days, essentially making them two-week events.

Those complaints have ratcheted up in recent weeks. Iga Swiatek, the world No. 1, complained of exhaustion throughout the summer. Carlos Alcaraz, the sport’s biggest young star, predicted the current schedule “is going to kill us in some way” in a news conference at the Laver Cup, another exhibition event.

Adding another event before the Australian Open would leave players feeling obliged to hit the ground running rather than playing themselves into form in Australia and New Zealand, where they can adjust to the time zone and climate in the weeks leading up to one of the year’s four most important tournaments.

With the tours unable to deliver what the Saudis were hoping for, plans for the new event and the Saudis’ biggest foothold in the sport remain a work in progress. That has allowed sports officials in the kingdom to approach the upcoming tennis events as a lab experiment.

What happens beyond that remains a mystery.

What happens during the next month, however, from how the players experience the event to whether locals and tourists fill the stadium, will dictate what happens down a still-unfinished road.

(Top photo: Adam Pretty / Getty Images)

Source link

meganwoolsey Home

meganwoolsey Home