Palantir Technologies (NYSE: PLTR) has become one of the latest companies to stand out in the high-growth area of artificial intelligence (AI). Even though this technology player has been around for about 20 years, earnings have truly taken off in recent times. This is thanks to Palantir’s Artificial Intelligence Platform (AIP), launched just last year, along with a surge in interest from commercial customers — in the past Palantir was most associated with government contracts.

And all of this has helped Palantir stock to soar 150% so far this year. In fact, the stock has reached its highest level ever, trading at valuations many would call expensive and well surpassing Wall Street’s average price estimate of about $28. At this point, is it a good idea to hold off on buying this high-momentum stock, or should you buy Palantir at the high? Let’s find out.

Helping make data a game-changer for customers

First, a little background on Palantir’s path so far. The software company helps governments, companies, and organizations aggregate their data in order to make the best use of it. While this many not sound exciting, it actually is — and often delivers results that are game-changing and/or help a customer register enormous savings in costs and gains in efficiency.

For example, Palantir’s systems for Cleveland Clinic help optimize patient placement, forecast bed availability, and boost overall efficiency at the hospital. United Airlines is using Palantir to help it manage equipment issues — to ensure maximum uptime. Since the launch of this predictive maintenance system, Palantir has helped United save millions of dollars through the avoidance of flight delays and cancellations.

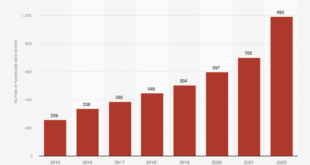

In Palantir’s earlier days, government contracts drove growth, and the company steadily but slowly increased revenue. But in more recent times, and with the launch of AIP, Palantir has posted double-digit revenue growth and has seen a massive gain in its commercial business — so that U.S. commercial growth now surpasses that of government revenue growth.

In the most recent quarter, U.S. commercial revenue advanced 55% to $159 million and U.S. commercial customer count jumped 83% to nearly 300. It’s important to remember that Palantir had only 14 U.S. commercial customers four years ago — so growth here truly has surged. Government revenue also continues to make impressive gains, climbing 23% in the quarter, so the company can count on both its traditional revenue driver as well as the new source of gains found in the commercial business.

“Unbridled demand”

Considering AIP launched rather recently, we’re in the early stages of this platform’s growth story, and this is reinforced by demand so far. The “persistent and unbridled demand… shows no sign of relenting,” chief executive officer Alex Karp wrote in a recent shareholder letter.

Palantir has devised a genius way of getting new customers on board. The company has created AIP boot camps to introduce the platform and help potential users spin up a use case in mere hours. In Palantir’s latest earnings call, the company said it closed a seven-figure deal with a big wholesale insurance broker about two weeks after a boot camp — and this isn’t an isolated event. So, the bootcamp system is working and driving significant growth.

Finally, in the latest quarter, Palantir brought in $134 million in net income — its highest quarterly profit ever.

Should you buy Palantir now?

All of this paints a bright picture for Palantir today and offers us reason for optimism about the future. But should you really buy Palantir at the high? The stock today looks expensive, trading at more than 122x forward earnings estimates. That makes it pricier than any of the Magnificent Seven stocks, the technology players that drove stock market gains earlier this year.

PLTR PE Ratio (Forward) data by YCharts

The answer to our question has to do with your investment style. If you’re a value investor, Palantir isn’t the right stock for you, and if you’re a growth investor focused on bargains, you probably wouldn’t choose Palantir at these levels. But if you’re a growth investor who doesn’t mind paying more for a stock today — with the idea that the earnings picture could change greatly, in a positive way, in the years to come — then Palantir may be a good choice for you.

Palantir is in the early days of this new growth story, led by AIP and new demand from commercial customers, and the AI market is in its early days of growth too. Today’s $200 billion AI market may reach $1 trillion by the end of the decade. All of these elements together suggest that even if you buy Palantir right now at the high, you could still have a lot to gain over the long term.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adria Cimino has positions in Amazon and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Palantir Technologies, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Palantir Stock: Buy at the High? was originally published by The Motley Fool

Source link

meganwoolsey Home

meganwoolsey Home