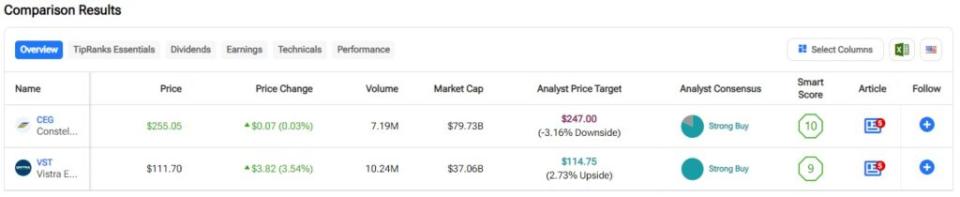

In this piece, I’m evaluating two electric utility stocks: Constellation Energy (CEG) and Vistra Energy (VST). A closer look supports a neutral view for Constellation Energy and a bearish view for Vistra Energy.

Constellation Energy is the largest U.S. producer of carbon-free energy and provides sustainable solutions to homes, businesses, and public-sector customers in the continental U.S. On the other hand, Vistra Energy produces electricity via natural gas and coal in addition to its nuclear and solar facilities. Vistra serves commercial, residential, municipal, and industrial customers in the U.S.

Shares of Constellation Energy have soared 119% year to date, including an 18% gain over the last three months. Meanwhile, Vistra Energy stock has skyrocketed 182% year to date. Both these stocks have delivered excellent performance for shareholders lately.

After Vistra’s much-larger one-year rally, it has opened up a sizable valuation gap versus Constellation Energy. I’ll compare these two companies in examining their valuations and their risk profiles.

The valuation of the energy industry as a whole is much lower than the P/Es we’re seeing for CEG and VST. An industry comparison is less helpful in this case.

A Closer Look At Constellation Energy (CEG)

Constellation Energy shares soared 25% to a record high on September 20 after it announced plans to reopen its Unit 1 nuclear plant on Three Mile Island. The nuclear plant will provide electricity for Microsoft’s data centers, and this should translate into big bucks for Constellation. The reopening is part of a 20-year deal that should help the software giant slash its carbon footprint. In a presentation, Constellation told investors it expects the Microsoft contract to boost its annual base earnings per share growth rate from 10% to 13% from 2024 to 2030. That seems like small compensation for the 25% higher share price, suggesting to me that CEG stock looks too pricey for new investors right now.

A potential risk is that Constellation hasn’t yet applied for any of the permits to reopen the facility, which was closed back in 2019 due to economic reasons. Furthermore, Constellation doesn’t even expect the permitting process to be finished until 2027 — if it receives the necessary reopening permits at all. According to Reuters, no U.S. nuclear power plant has ever been reopened after being shut down, so the whole venture seems unprecedented.

While the Microsoft deal was a shot in the arm, Constellation Energy stock is now in overbought territory with a Relative Strength Indicator of about 80. Thus, a downside correction could be right around the corner, which might then present opportunistic investors with a buy-the-dip opportunity, mitigate some of the risk of the project.

At a P/E of 34x, Constellation Energy is trading at a sizable discount to Vistra Energy, however. I still believe that a neutral view is appropriate at this time given the run-up in shares, along with the implementation risks for rebooting the old nuclear plant. Constellation Energy already operates the largest fleet of nuclear plants in the United States.

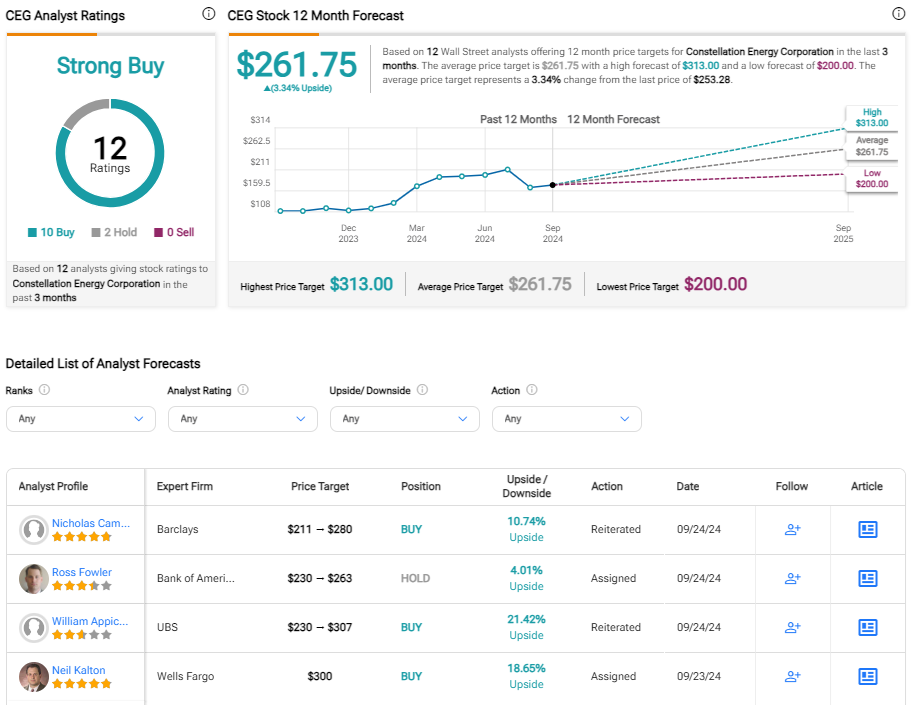

What is the Price Target for CEG stock?

Constellation Energy has a Strong Buy consensus rating based on 10 Buys, two Holds, and zero Sell ratings assigned over the last three months. At $261.75, the average Constellation Energy stock price target approximates the most recent trading value for CEG stock.

A Closer Look At Vistra Energy (VST)

At a P/E of 87x, Vistra Energy is trading at a sizable premium to Constellation Energy despite its involvement in natural gas and coal. The company’s transition from coal to cleaner energy sources is a huge positive, and the stock has soared thus far in 2024. In my view, however, it’s simply overvalued at current levels, opening the prospect for a bearish view.

Just like Constellation, Vistra stock jumped to a new record high this past week and is now in overbought territory with a Relative Strength Index of 81. Here too a correction certainly seems quite possible, especially considering how expensive the stock is. Vistra Energy’s valuation has been quite volatile over the past five years. The company wasn’t even profitable in 2022 or 2021 and has now generated net income of $648 million in the last 12 months on ~$14 billion in revenue. That’s a fairly slim net income margin of 4.6%.

Vista’s uneven quarterly results may be excusable due to the company’s ongoing transition from coal to clean energy sources. According to its 2023 sustainability report, Vistra is making progress on that transition, having achieved a 9% reduction in Scope 1 greenhouse gas emissions year over year. The company also states that it has a clear path to hitting its reduction target for 2030. However, this transition also means Vistra Energy faces more broad-based risks than Constellation Energy, which doesn’t burn any coal, although it does burn oil according to its 2024 ESG factsheet.

Nuclear energy is far more reliable than solar power, and Vistra seems focused on adding nuclear capacity through acquisitions of nuclear plants. In 2023, Vistra acquired three nuclear facilities. Of course, such acquisitions require a significant amount of capital investment.

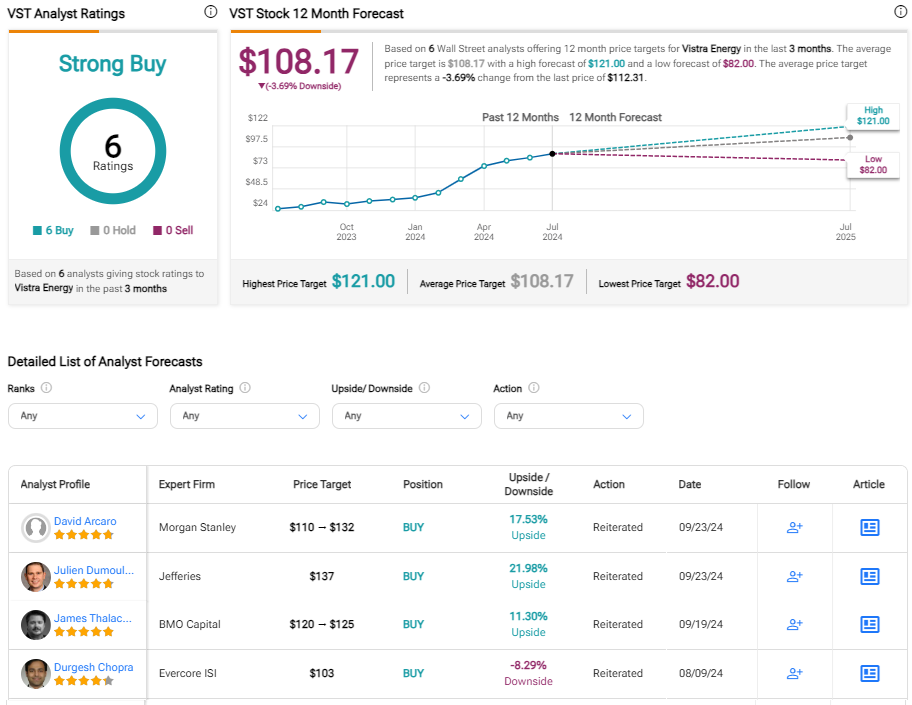

What is the Price Target for VST stock?

Vistra Energy has a Strong Buy consensus rating based on six Buys, zero Holds, and zero Sell ratings assigned over the last three months. However, the recent jump in the share price has vaulted the stock above the average VST stock price target of $108.17. Investors may wish to monitor any price target changes from analysts who cover VST.

Conclusion: Neutral on CEG, Bearish on VST

A quick glance at TipRanks’ News page for Constellation Energy reveals multiple price target increases, verses a smaller number for Vistra.

Both companies face their share of risks, although Vistra’s risks are arguably more broad-based due to its transition away from coal and expansion of solar energy. On the other hand, Constellation faces a unique risk in attempting to recommission the Three Mile Island nuclear plant.

Constellation looks like the better stock holding at this point, although I have a neutral rating. CEG stock looks like the better buy than VST on any pullback.

Source link

meganwoolsey Home

meganwoolsey Home