(Bloomberg) — Algorithms helped foreign funds and proprietary trading desks pocket 588.4 billion rupees ($7 billion) in gross profits from trading Indian equity derivatives, a study by the nation’s market regulator showed.

Most Read from Bloomberg

The bulk of the gains came at the expense of individual traders and others, who lost a combined 610 billion rupees dabbling in stock futures and options in the financial year ended March, according to the study published Monday.

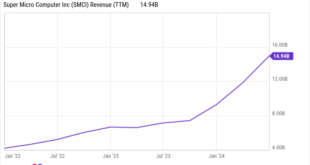

The findings align with the Securities & Exchange Board of India’s push to slow the growth of the derivatives segment, whose turnover has skyrocketed over 40-fold since 2019, reaching a record $6 trillion in February — surpassing the size of India’s economy. SEBI has repeatedly cautioned small investors that they are taking a big risk in trying to bet against better-funded and more experienced financial market players.

“There is little scope for individual traders to beat a mathematically-written model,” said Karthick Jonagadla, chief executive officer of Mumbai-based Quantace Research and Capital Pvt. “Trading equity options is altogether a different beast and chances of having a reward-to-risk ratio in your favor are minuscule.”

India’s derivatives market grabbed global attention in April after US-based Jane Street Group revealed that a strategy used in the country generated $1 billion in profits. The revelation also shed light on how smaller investors are often at the wrong end of the trade.

Nine out of every 10 retail derivatives traders lost money during the three-year period ended March, with the average loss per trader at about 200,000 rupees, SEBI’s latest study showed. Only 1% of traders made profits of over 100,000 rupees. More than 75% of the 10 million individual traders in India declared annual income of less than 500,000 rupees.

A large part of the growth in India’s derivatives market was fueled by the start of weekly-expiring contracts in 2019, which replaced the traditional month-end expirations. These shorter-duration options stoked volumes, benefiting the National Stock Exchange of India, which has over 90% market share, and stock brokers.

(Updates with context in final paragraph, adds chart.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link

meganwoolsey Home

meganwoolsey Home