Oil prices have been on a downward trajectory since peaking in April. WTI, the primary U.S. oil price benchmark, has fallen from more than $85 a barrel to its recent level of around $70. That slump will have varying impacts across the oil patch.

Chevron (NYSE: CVX), Plains All American Pipeline (NASDAQ: PAA), and Enterprise Products Partners (NYSE: EPD) stand out to a few Fool.com contributors for their more resilient businesses. Here’s why these energy stocks should prosper no matter what happens with crude oil prices.

Chevron is solid as a rock

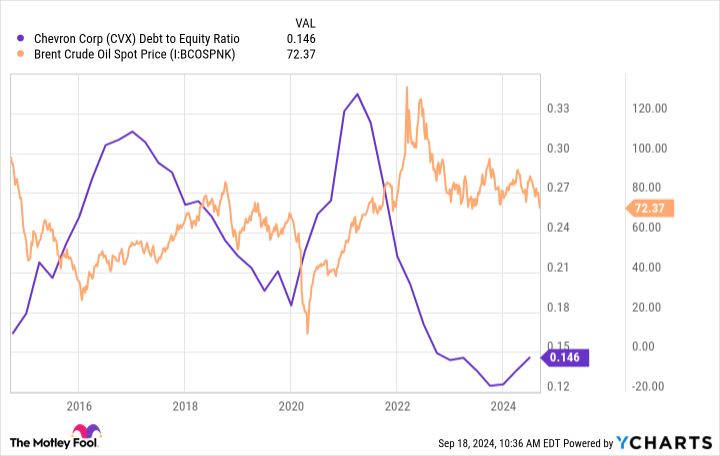

Reuben Gregg Brewer (Chevron): Chevron is well aware of the volatile nature of energy prices and what big oil and natural gas swings can do to its income statement. That’s why it pays so much attention to its balance sheet. And you should, too.

To start with a number, Chevron’s debt-to-equity ratio is a very low 0.15. That’s the lowest leverage among the company’s closest peers (and would actually be low for any company in any industry). This isn’t some small detail, given the cyclical nature of the industry. Simply put, low leverage gives Chevron the wherewithal to prosper in any oil market.

This is because Chevron has the room to add leverage when oil prices are weak, which allows the company to continue investing in its business and to pay its dividend. The dividend, for reference, has increased for 37 consecutive years, an incredible feat given the industry in which Chevron operates.

When oil prices recover, as they always have, Chevron reduces its leverage in preparation for the next downturn. Conservative income investors looking for an all-weather energy stock will be hard pressed to find a better option than 4.5%-yielding Chevron.

A well-oiled income-producing machine

Matt DiLallo (Plains All American Pipeline): Plains All American Pipeline operates an extensive network of oil pipelines, storage terminals, and natural gas liquids (NGL) infrastructure. The master limited partnership (MLP) primarily gets paid fees as crude oil and NGLs flow through its critical and integrated networks. Because of that, falling oil prices have minimal impact on its cash flows.

This year, the midstream company expects to generate more than $2.7 billion of adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA). It recently raised the midpoint of its guidance range by $75 million due to its strong first-half showing and outlook for the balance of the year. That updated outlook “underscores the resilience of our business model and highlights the flexibility of our asset base to capture opportunities in a dynamic and evolving market,” stated CEO Willie Chiang in the second-quarter earnings report.

Plains All American Pipeline expects to produce about $1.6 billion in adjusted free cash flow this year after funding growth capital projects (about $375 million). It will distribute nearly $1.2 billion of that cash to investors (the MLP’s distribution currently yields over 7%). The remaining money will help fund accretive bolt-on acquisitions, further debt reduction, or other investment opportunities. The company’s expansion-related investments should grow its earnings and cash flow.

The MLP’s ability to generate stable and growing cash flow drives its belief that it can steadily increase its cash distributions. It’s targeting to boost its payout by $0.15 per unit annually after 2024 (a double-digit rate from the current level). That’s after giving investors a 23% raise earlier this year. With Plains All American’s stable cash flow, a strong balance sheet, and a well-covered payout, investors can bank on this income stream even if oil prices continue to slide.

A wise approach

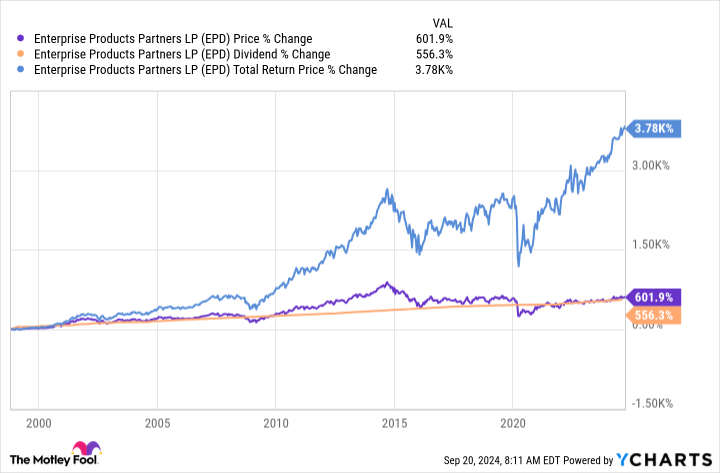

Neha Chamaria (Enterprise Products Partners): No oil stock is fully immune to the volatility in oil prices. Still, some companies can not only generate stable income and cash flows during an oil market turmoil, but also pay out regular dividends to their shareholders no matter where oil prices go.

Enterprise Products Partners, for example, has increased its dividend every year for 26 consecutive years. That period includes some of the toughest years for the oil market in history, including 2020, when oil prices plunged into the negative, even forcing some oil companies to slash their dividends.

While Enterprise Products’ business model hugely helps, the company also proactively adjusts its capital spending in response to market conditions to preserve cash where required. So on the one hand, the oil and gas pipeline giant generates steady cash flows under long-term contracts. On the other, it uses cash in such a way that it can continue to pay out bigger dividends every year while balancing debt management and growth spending.

Enterprise Products Partners’ strategy has worked well so far, as evidenced by its as evidenced by dividend growth, which has hugely contributed to shareholder returns over the decades.

Enterprise Products Partners is one of the largest midstream energy companies in the U.S., maintains a strong balance sheet, has projects worth nearly $6.7 billion under construction, and is committed to returning value to shareholders at all times. So no matter where oil prices head next, this 7.2%-yielding energy stock can prosper.

Should you invest $1,000 in Chevron right now?

Before you buy stock in Chevron, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Matt DiLallo has positions in Chevron and Enterprise Products Partners. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Oil Prices Are Down. Here Are 3 Energy Stocks That Can Prosper No Matter Where Prices Go Next. was originally published by The Motley Fool

Source link

meganwoolsey Home

meganwoolsey Home