From sifting through investor presentations and corporate filings to listening to earnings calls and watching interviews, getting a firm gauge on an investment often requires a lot of work.

One thing that I like to do is analyze 13F filings. These are forms filed by investment firms managing over $100 million in stocks. One of the more high-profile hedge funds is Ken Griffin’s Citadel. Last quarter, Citadel reduced its stake in Nvidia (NASDAQ: NVDA) by 79% — dumping 9,282,018 shares. In addition, the firm increased its position by 1,140% in Palantir Technologies (NYSE: PLTR), scooping up 5,222,682 shares.

Let’s dig into what may have compelled Griffin and his portfolio managers to sell Nvidia and buy Palantir. Moreover, I’ll explore what catalysts could help fuel even more growth for Palantir — and why now could be a great time to follow Griffin’s lead.

Why sell Nvidia right now?

On the surface, selling Nvidia stock might look like a questionable move. After all, isn’t artificial intelligence (AI) the next big thing?

Well, even if AI ends up being the generational opportunity it’s being touted to be, that doesn’t mean a whole lot at face value. There are many components to the foundations of AI, and Nvidia’s expertise in the development of advanced chipsets called graphics processing units (GPU) is just one of many building blocks supporting artificial intelligence.

The biggest bear narrative surrounding Nvidia stems from rising competition. At present, products developed by Advanced Micro Devices and Intel are the most obvious alternatives to Nvidia. However, I see a bigger risk in the competitive landscape.

Namely, Nvidia’s big tech cohorts including Tesla, Meta Platforms, Microsoft, and Amazon are all investing heavily into their own hardware development. Considering that many of these companies are Nvidia’s own customers, I’m wary that the company’s current growth trajectory is sustainable in the long run.

When more GPUs come to market, there is a good chance this technology will be viewed as somewhat commoditized. Such a dynamic will likely lead to lower prices for Nvidia, which will subsequently bring decelerating revenue, margins, and profits.

All told, I don’t really blame Griffin for selling such a large portion of his Nvidia position. Despite the company’s success so far, its future prospects look potentially questionable.

Why buy Palantir right now?

In a different area of the AI landscape sits enterprise software company Palantir. It offers four data analytics platforms called Foundry, Gotham, Apollo, and AIP. The company’s software is used across a host of use cases throughout the U.S. military and private sector.

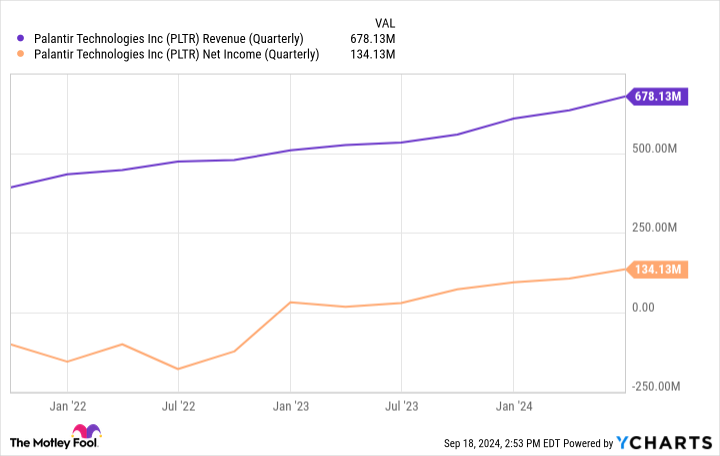

Investors can see that over the last couple of years, Palantir’s revenue accelerated on the backdrop of a bullish AI narrative. More importantly, the company’s operating leverage has improved dramatically in the form of margin expansion and consistent profitability.

Earlier this month, Palantir also achieved the notable milestone of inclusion in the S&P 500.

Should you buy Palantir stock right now?

I can’t say for certain why Griffin increased his stake in Palantir so much last quarter, but I do find the timing interesting for one particular reason. Palantir has been eligible for the S&P 500 before but was not initially chosen. Perhaps some thought Palantir’s newfound growth was purely an extension of demand for AI software and would not be sustainable in the long run.

Whatever the case, I think those who have followed Palantir for a long time understood that the company’s long-run prospects looked solid — regardless of the current AI narrative. Bearing that in mind, it was reasonable to think that the company would be included in the S&P 500 eventually.

This leads me to a broader point. Now that Palantir is in the S&P 500, there is a good chance more investment banks and research analysts will begin following the company more closely. In turn, this could lead to an increase in institutional investors buying the stock. Over time, this could strengthen Palantir’s brand and perception in the investment community and bring the stock to even higher prices.

I think there is a good chance Palantir will witness a rise in institutional ownership. The company is quickly emerging as a force in the AI software arena, and has even attracted the likes of Microsoft and Oracle — two relationships that I think will bring even further growth to the company.

I very much see even better days ahead for Palantir, and think now is a great time to buy shares. With so many catalysts fueling the company’s upside, I see Griffin swapping Nvidia for Palantir as a particularly savvy move.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon, Meta Platforms, Microsoft, Nvidia, Palantir Technologies, and Tesla. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Meta Platforms, Microsoft, Nvidia, Oracle, Palantir Technologies, and Tesla. The Motley Fool recommends Intel and recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Billionaire Ken Griffin Just Sold 9.3 Million Shares of Nvidia and Bought This Other Artificial Intelligence (AI) Stock That’s Headed to the S&P 500 Instead was originally published by The Motley Fool

Source link

meganwoolsey Home

meganwoolsey Home