Bill Gates and Warren Buffett have a lot in common despite their age difference. Both are multibillionaires. They’re philanthropists. Both enjoy playing bridge. And they’re both investors.

The two wealthy men now share even more in common on the investing front. The Bill & Melinda Gates Foundation Trust loaded up on Buffett’s favorite stock in the second quarter of 2024. Should you buy this stock, too?

Buffett’s favorite stock looks like Gates’ favorite these days

There’s not much of a mystery about the identity of Buffett’s favorite stock. He owns 15.1% of the aggregate economic interest in Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) Class A and Class C shares. This stake is worth roughly $146 billion right now.

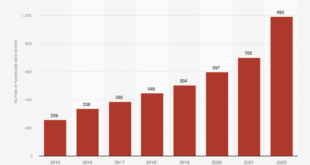

Berkshire Hathaway also looks like it might be Gates’ favorite stock these days. In Q2, his trust bought an additional 7.32 million shares of the conglomerate, increasing its stake by a whopping 42%.

Sure, Microsoft, the company Gates co-founded, remains the largest holding in the Bill & Melinda Gates Foundation Trust’s portfolio. However, the trust sold more than 1.6 million shares of the tech giant in Q2.

Gates’ trust didn’t buy any stock besides Berkshire Hathaway during the second quarter. Its only other transaction was exiting a position in online used car retailer Carvana.

Why did Gates’ trust load up on Berkshire Hathaway stock?

Neither Gates nor anyone else associated with the charitable trust that he and his former wife founded commented on the big purchase of Berkshire Hathaway shares in Q2. However, we can make some pretty good guesses as to why the trust opted to load up on the stock.

I suspect one key reason behind the increased stake is the diversification that Berkshire Hathaway offers. The conglomerate operates over 60 businesses spanning a wide range of industries. It owns positions in over 40 other publicly traded companies with very little overlap with the other stocks in the Bill & Melinda Gates Foundation Trust’s portfolio.

Another likely factor for the hefty purchase is the long-term performance of Berkshire Hathaway stock. Gates’ trust first initiated a position in Berkshire in the second quarter of 2010. Since then, Berkshire’s share price has skyrocketed more than 460%.

Between 1965 (the year Buffett took control of Berkshire Hathaway) and 2023, the holding company delivered a compounded annual gain of 19.8%. By comparison, the S&P 500‘s compounded annual gain during the period was a much lower 10.2%. Berkshire is also handily outperforming the S&P 500 so far in 2024.

Should you buy Berkshire Hathaway stock, too?

It isn’t a good idea to base your investment decisions blindly on what billionaires or their charitable trusts do. However, in this case, I think many investors could do well following in the footsteps of Buffett and Gates.

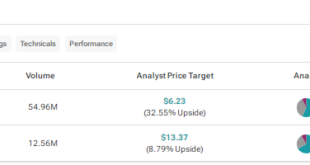

Granted, Berkshire Hathaway isn’t a good pick for every investor. If you’re looking for income, you’ll be out of luck. Berkshire has never paid a dividend in its history. Also, even though Buffett is a famous value investor, his favorite stock isn’t especially cheap. Although Berkshire’s forward earnings multiple of 19.3 is less expensive than the S&P 500, it’s not low enough to attract the favor of most value investors.

But the diversification and long-term performance offered by Berkshire Hathaway are hard to beat for long-term growth investors. Berkshire has also built a massive cash stockpile of around $277 billion that could enable Buffett and his team to aggressively buy solid stocks at a discount when the next major market sell-off comes.

Buffett’s and (arguably) Gate’s favorite stock doesn’t have to be your favorite stock. However, I suspect Berkshire Hathaway will continue its winning ways for a long time to come.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Keith Speights has positions in Berkshire Hathaway and Microsoft. The Motley Fool has positions in and recommends Berkshire Hathaway and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Billionaire Bill Gates’ Trust Loaded Up on Warren Buffett’s Favorite Stock in Q2. Should You Buy It Too? was originally published by The Motley Fool

Source link

meganwoolsey Home

meganwoolsey Home