-

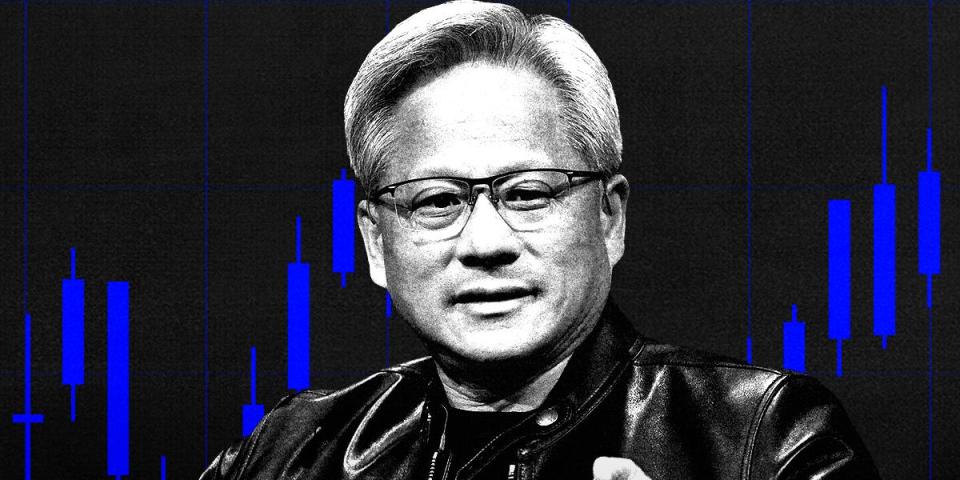

Investors continued to sell Nvidia stock, sending the chipmaker 4% lower on Friday.

-

Shares are on track to end the week 14% lower amid news of an antitrust probe.

-

The stock is flirting with $100 a share, a key technical threshold watched by analysts.

Nvidia stock extended its post-earnings decline on Friday, with shares of the chip maker flirting with a key technical level amid a wider tech sell-off in the session.

Nvidia shares slid over 4.5% on Friday, trading around $102.15 a share. That puts the stock close to a key psychological threshold of $100 a share and its 200-day moving average just below $90.

Traders are eyeing those levels for signs that the chip titan’s blistering rally may be fading, analysts told Business Insider this week. Wall Street, though, generally remains bullish on the outlook for the stock, of which analysts have projected an average price target of $153 a share, according to Nasdaq data.

Investors have been cautious on Nvidia stock since the company posted second-quarter financials that beat earnings estimates but not quite enough to meet the loftiest expectations.

The stock staged a small recovery earlier this week, but continued its steep sell–off after a report from Bloomberg that said the Department of Justice was probing the company over antitrust concerns.

“While every case is different, we also highlight the plethora of govt. cases ongoing against other large US tech companies over the last several years. Until we have more details, we assume no specific material impact on NVDA’s fundamental opportunity,” Bank of America strategists said in a note, reiterating their “buy” rating on the stock.

Nvidia has lost around $500 million in market value from levels in early June, with the firm being valued at $2.53 trillion on Friday. The stock is on track to end the week 14% lower, though shares are still up 111% from levels at the start of the year.

The slide on Friday came amid a larger decline in tech, with the Nasdaq Composite down 2.5% at 2:00 p.m. ET. Investors were fleeing high-flying growth names after the August jobs report was weaker than expected, sparking new fears about an economic slowdown.

Read the original article on Business Insider

Source link

meganwoolsey Home

meganwoolsey Home